Economic Review

GDP report: Economy grew at 3.4%

Slowly, in fits and starts, real GDP is growing and employment is increasing. Most economic forecasts believe GDP growth of 3.8% in the current quarter, with 3% growth expected for the duration of the forecast’s 2013 horizon. This 3.1% growth rate beat the estimate of 2.8%. It is also estimated that payroll employment increases of 1.9 million in 2011, 2.6 million in 2012 and 3.0 million in 2013. But, as above, these increases in employment will not bring the U.S. back to the employment peak of first quarter 2008.

The economy is being propelled by strong increases in corporate spending and software and that the impetus for this spending is coming from extraordinarily low interest rates, a rapidly recovering stock market and investment incentives coming out of Washington D.C. Investment is being spurred by technological advances in wireless and cloud computing along with new natural gas drilling and technologies that are reshaping the nation’s energy map. As a result, the real business investment share of GDP will increase from 12.8% in 2010 to 15.4% in 2013. Exports and the automobile sector are also spurring the recovery, the latter a rebounding as pent-up demand spurs new car sales. An improving employment sector will push housing starts to 1.5 million (up from 586,000 in 2010).

California Economy

California sees a stream of new jobs as the state posts the largest increase in employment total for the United States. This is a clear sign that the California economy is rebounding, with nearly 100,000 new jobs added in February. This is a very good sign for California since before the recession. The recovery of the labor markets appears to be speeding up as expected and job growth will continue to expand, becoming much stronger by the second half of 2011 and moving forward in 2012. This a good trend and should continue as workers redefine their skillset to meet the needs of the employers and the driving forces of the new economy. The numbers show resurgence in technology, foreign trade, tourism and entertainment.

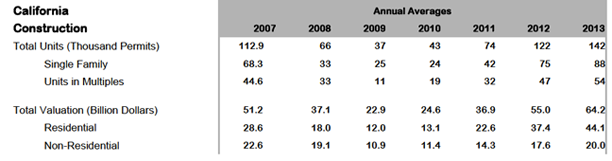

California Construction Expected to Rebound

Architecture Billings

Architecture Billings Index Shows Nominal Increase

During the first two months of 2011 the Architecture Billings Index (ABI) is not exhibiting the strength of business conditions that were seen in the final quarter of 2010. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.6, up slightly from a reading of 50.0 the previous month. This score reflects a modest increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.4, compared to a mark of 56.5 in December.

About WAM & Associates

William A. Martinet is a seasoned executive with several years’ experience in economic research & analysis. The group’s broad area of practice includes business analysis & planning real estate, and use and financial analysis. For more than 30 years, William Martinet has helped clients turn opportunity and challenge into success by practical advice, innovative solutions and valuable business planning. In addition to individual client advisory services. Mr. Martinet was an executive at Sunkist Growers where he held positions in Strategic Planning, Sales & Marketing and Growers Relations.

Contact: 805.405.2190 | wam91362@yahoo.com